Are Brands Too Dependent On Amazon For Their eCommerce Strategy?

A Custom Report by:

Methodology

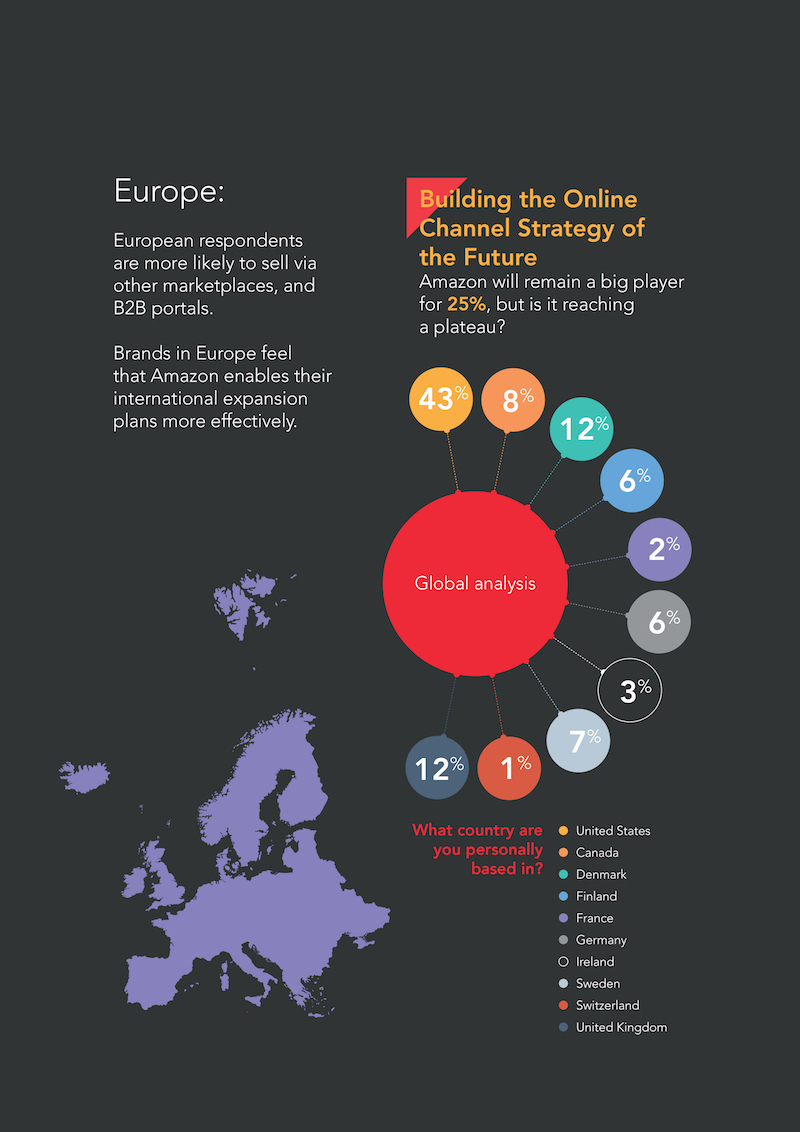

In Q1 of 2017 WBR Digital surveyed 130 senior decision makers at major manufacturers in Europe and the USA. Participants of the research include VPs, Heads of eCommerce, Directors of Marketing and Heads of Digital Marketing, amongst others of equal standing. All interviews were conducted by appointment over the telephone. The results were compiled and anonymized by WBR Digital and are presented here with analysis and commentary by Luzern.

Over the next few years we believe there will be a shift of power back to branded manufacturers.

Ken Doyle, CEO, Luzern

Contents

- Foreword

- What We Learned

- Interview with Ken Doyle, CEO, Luzern

- Part 1 | Leaning on Amazon

- Part 2 | Keeping Control of Your Business

- Part 3 | Building the Online Channel Strategy of the Future About Luzern

- About WBR

Foreword

All companies agree: no matter the share of online revenue going through Amazon right now, the future belongs to companies who diversify their eCommerce strategy.

The digital revolution has completely changed the sales landscape for branded manufacturers. Where historically they relied on

a network of retailers and resellers to bring their products to market, they now have a much lower barrier to reaching their customers directly.

In the early days, selling their products via a ready-made platform like Amazon was a valuable way to dip their toes into the waters of eCommerce. Our research demonstrates that the two biggest advantages of working with Amazon for them are the low cost of getting to market, and the flexibility the platform offers.

However, more than four in ten branded manufacturers in the USA & Canada today count on Amazon for 21% or more of their online revenue. This is a huge chunk to be sitting in one channel alone.

Looking into the future, only a quarter of manufacturers believe that Amazon will be a high sales opportunity. Clearly, manufacturers realize that this channel may be reaching a plateau.

Of course, there are also other risks associated with maintaining a narrow approach to channel strategy. Manufacturers are very likely to suffer from diminishing returns, susceptibility to disadvantageous changes to the platform, and a have a lack of control of over their brand reputation, ownership of the pricing strategy and their ability to fulfill orders.

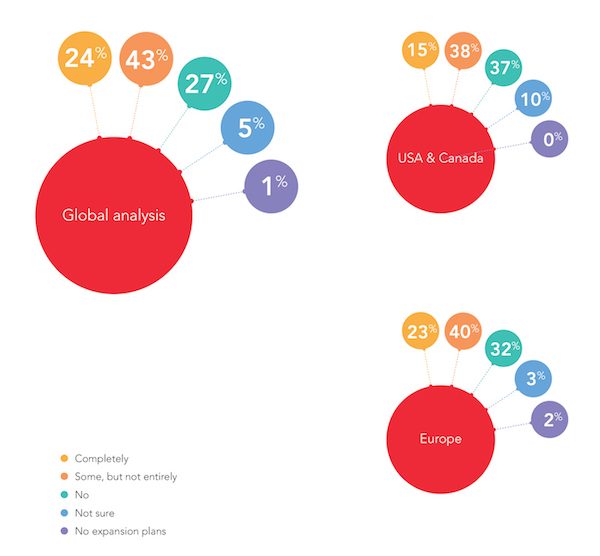

In addition to this, few brands (24%) feel that Amazon supports their online international expansion plans entirely, meaning strategic support will have to come from other channels.

To mitigate these risks manufacturers are seeking to diversify their online strategy over the next five years in a number of ways. Firstly, by focusing on direct-to-consumer online stores, developing the use of other channels, like Alibaba for instance, and to a lesser extent, selling using social media and B2B portals.

If manufacturers are able to master their own destiny in terms of sales online, they will see their channels diversify and their revenues continue to grow. The future for innovative brands who seek to build relationships with their customers directly is very bright.

Interview with Ken Doyle, CEO, Luzern

How do you see the relationship between manufacturers and Amazon evolving in the next few years?

Over the next few years, we believe there will be a shift of power back to the branded manufacturers as more of them diversify their online strategy. Amazon’s position will be diluted in the process, ultimately leading to a fairer and more balanced approach by the online giant towards companies that own recognized brands and create more value online.

We believe this because of what we hear from our clients. They may work in diverse

verticals but all of them expect both pain and gain over the short and long term working with Amazon, all of this due to their shifting priorities.

Initially, it was important to get selling online no matter where, no matter how. That’s why Amazon was such an attractive option for branded manufacturers. But now that the market is more mature, the total cost of this channel will come under more scrutiny, and that’s where the pain comes in. Costs of promotions, of dedicated account managers, or constant monitoring will erode margins, and that’s bad news no matter what vertical is impacted.

Brands should ask themselves: “How loyal is an Amazon customer to my brand? Will Amazon share the details of customers for which my brand is responsible? Who owns this customer? Will Amazon promote my competitor’s product using the information resulting from my sale?” These questions will only increase in importance as margins are eroding and the complete cost of having Amazon as the cornerstone of your online strategy becomes clear.

What are some of the issues for companies who rely too heavily on Amazon?

I just mentioned that it might be challenging for companies to be heard by Amazon, and that’s true in two ways: on a broader, more strategic level, but on a tactical day-to-day level as well. Amazon can be a difficult channel to manage due to price changes, product reviews, and customer service. Getting mind-share from Amazon when so many brands in your industry are willing to work with them is a challenge, and it’s worth considering whether that’s a trade-off you’re willing to accept. If we also throw in the balancing act required between Amazon Retail and Merchant, the result for companies too reliant on Amazon will undoubtedly be an increase in time managing the channel, which will further erode their margins and impact their bottom line. This becomes dangerous for brands as they may be helpless should Amazon switch them off looking for better margins elsewhere.

What are the big opportunities for manufacturers selling directly to consumer via eCommerce?

I know this might be stating the obvious, but putting more importance on selling directly to consumers means reducing the distance between a brand and the purchaser of its products, no matter if that’s in a B2C or B2B setting. Financially speaking, the upfront investment necessary to manage a balanced online strategy will create a much more stable ROI for the brand over time. This is especially true when considering the potential impact of higher margins and the lifetime value of your customers on your bottom line.

We have numerous clients that started out selling in new markets on Amazon only. Any brand that decides to invest in direct-to-consumer eCommerce can, in a relatively short time frame, identify new opportunities when introducing new products, launching promotions or even when wanting to expand to new markets. With Luzern’s eCommerce Platform our clients have a range of tools and expertise available that enable them to build a robust online capability, as well as a footprint that provides access to millions of customers in global markets. This means that our clients can focus on building their brand and their customer’s loyalty, delivering more value over the lifetime of the customer, and diminishing any issues with channel conflict.

What are some of the internal roadblocks you most commonly see?

Without question, the most frequent roadblock we see can be summarized in two words: channel conflict. Manufacturers have long counted on a network of retailers and distributors to sell their products and in the process a number of relationships and expectations have been formed. Any attempt at online endeavors will test these relationships – if you’re lucky this will result in a positive embrace, but if you’re not, it could result in a series of unfortunate trade-offs between distributors, retailers, partners and customers.

How can they be overcome?

What’s important for all stakeholders to understand is that maintaining the status quo is extremely short-sighted which sweeps a difficult conversation under the rug where it will turn into a catastrophic situation. A number of brands have already lost significant market share, revenue as well as margins by not embracing a comprehensive online strategy. Brands should ask themselves: “Will my customers of the future increasingly go online to buy my product?” For any company, the answer to this question is a resounding YES. So are you willing to allow Amazon to be your most significant – or only – route to these precious customers? Or are you willing to invest in a strategy that you can control, enabling you to target your customer no matter where they shop?

The best way that roadblocks can be overcome is if there is a clear strategy from the top. Companies have to determine whether direct-to-consumer eCommerce is a mere window-dressing activity, or a pillar of growth that will drive significant revenue.

If it’s the latter, it’s important to form clear and shared objectives across teams, with targets all related to this objective. This can mean re-working commission policies for the sales team to drive sales online, or KPIs for the marketing team not only based on volume, but also on value and order size. Every company is different, and that’s why it’s important to have access to a knowledgeable partner that can help deliver growth now and in the future.

Brands should ask themselves: “Will my customers of the future increasingly go online to buy my product?” For any company, the answer to this question is a resounding YES.

Part 1: Leaning on Amazon

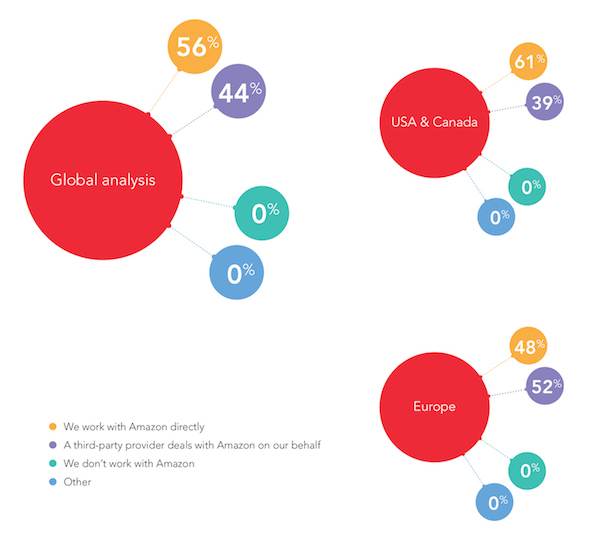

Does your company deal with Amazon directly, or does a third-party provider deal with Amazon on your behalf?

Companies in the USA are 13% more likely to be working with Amazon directly than those in Europe. Feedback from our clients suggests that the support available in Europe is less comprehensive than that in Amazon’s home market, and this may well account for the difference. However, this means that any company serious about driving significant sales on Amazon in Europe – no matter if they are American or European – should consider working with a third- party if they don’t already have local expertise in place.

Manufacturers in the USA and Canada are 13% more likely to work with Amazon directly than their European counterparts

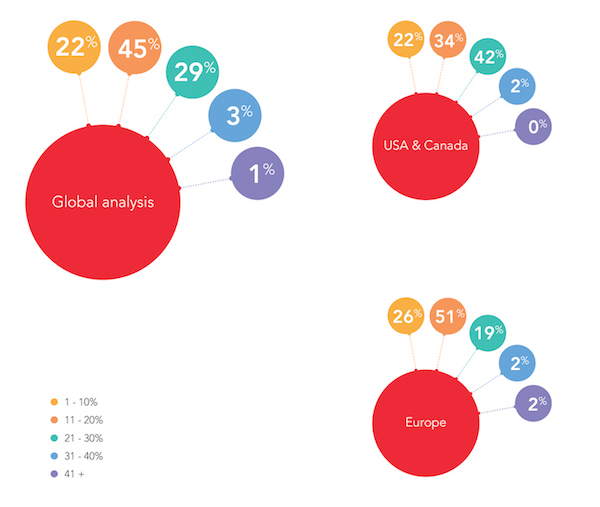

What percentage of your total online sales come from your company selling on Amazon?

More than a third of responding manufacturers globally get 21% or more of their online revenue from Amazon

Selling a large amount via any channel is great news. But if a large percentage of your sales are coming from a single source, like Amazon, then you are effectively handing over control of a huge chunk of your online sales.

Over 40% of respondents in the USA & Canada count on Amazon for 21% or more of their online revenue. This is surprising as the North American market is typically more price-driven, and Amazon is usually one of the lower-margin channels for a company selling online.

Manufacturers who have this kind of over-reliance on Amazon have cause for concern. A more stable and sustainable strategy for growth would focus on a more diverse approach to online sales channels.

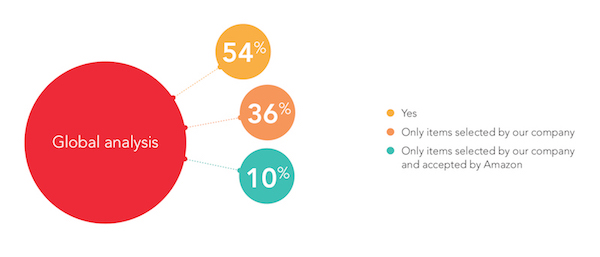

Is your entire product range listed on Amazon?

Approximately half of companies surveyed worldwide stock their entire product range on Amazon. That means that the other half of companies could further grow their online sales by listing more products on this channel.

Quite interestingly, we can also see that 10% of companies are at the mercy of Amazon when it comes to product selection, another example of a loss of control over your own inventory.

Approximately half of manufacturers selling on Amazon globally stock their entire product range.

Part 2: Keeping Control of Your Business

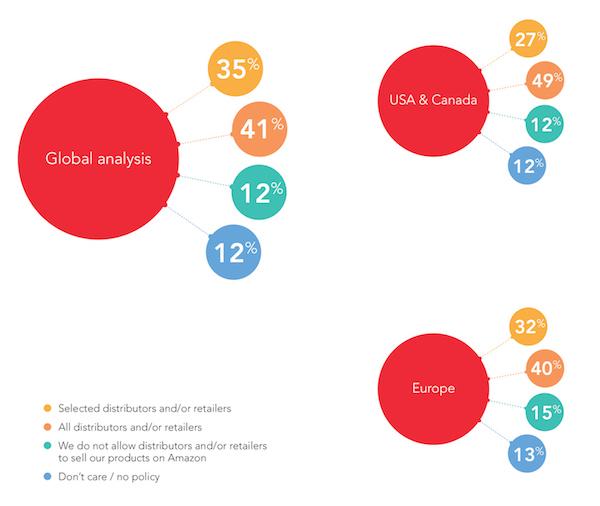

Do you allow your distributors and retailers to sell your products on Amazon?

European companies appear to have a greater control over their retailers and distributors on Amazon. This is interesting given our earlier finding that they are also more likely to work with a third-party or partner to sell on this channel.

From our experience on Amazon with companies from both continents, European brands have the luxury of a market that is not as competitive as in the United States. This enables greater control over their strategy.

European respondents are less likely to work with a wide range of distributors or retailers

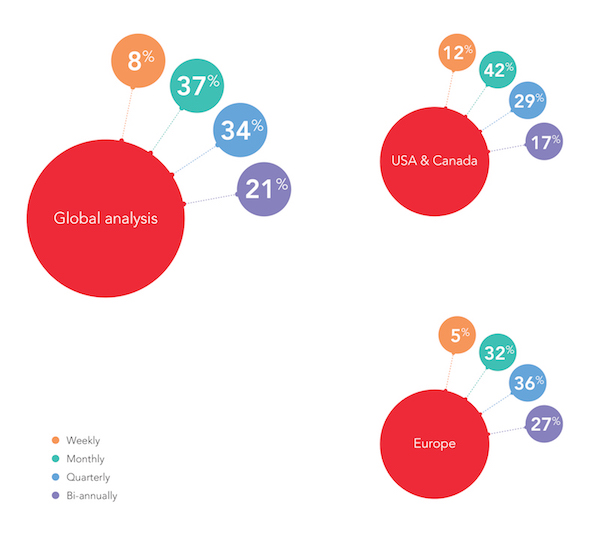

How often do you adjust your pricing on Amazon?

More than half of respondents in the USA & Canada adjust their pricing on Amazon either monthly or weekly

Answers to this question have undoubtedly changed over the years. While companies used to review their pricing on Amazon a couple of times a year, more than 41% of respondents in the USA and Canada now adjust their pricing on Amazon at least on a monthly basis.

This has a direct impact on the eCommerce platform a brand might use – advances in technology mean that the ability to react in real time to data is a powerful tool. In fact, many companies approach because of our platform’s ability to do just that.

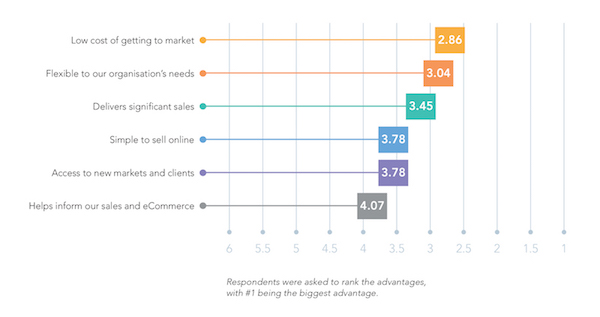

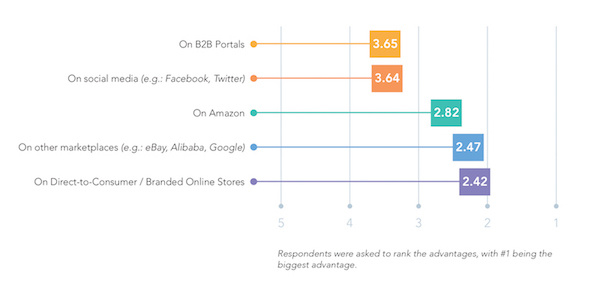

What do you consider the biggest advantages of working with Amazon as part of your eCommerce strategy to be?

The low cost of getting to market with Amazon is a big advantage for companies, along with flexibility and volume of sales. These benefits, however, come at a price: complexity and a lack of intelligence with which to inform the brand’s long-term eCommerce strategy.

This last point is important. Amazon is always going to look after Amazon first. This can cause a number of potential problems for manufacturers, not least that Amazon has no particular loyalty to your brand. Companies have experienced this first-hand, some experiencing their products summarily removed from sale, or bait and switching. Branded manufacturers should beware of short-term benefits at the expense of long-term growth.

The low cost of getting to market is a big advantage for respondents, along with flexibility and volume of sales.

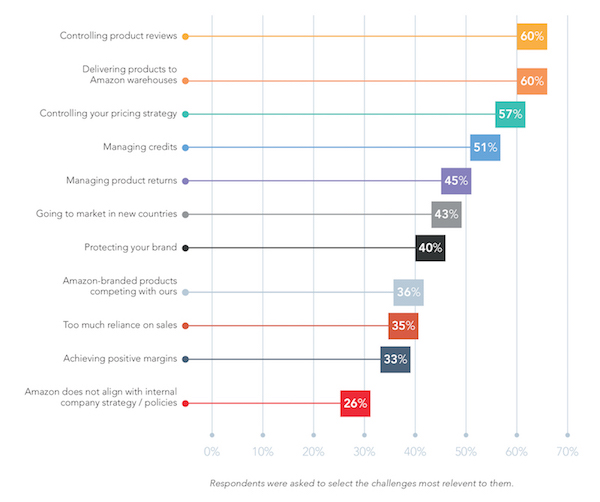

Which of the following do you consider to be biggest challenges of working with Amazon as part of your eCommerce strategy?

Controlling brand reputation and concerns around fulfillment of orders are some of the biggest challenges named by respondents

Social proof is a huge part of succeeding in online retail, and can have a huge impact on an individual customer’s purchasing decision – hence the importance of product reviews in the eyes of our respondents.

This plays into other concerns around controlling brand reputation and fulfillment of orders, and these were named as some of the biggest challenges by our respondents.

Amazon may never be able to protect brand reputation or experience better than channels where companies have greater control, such as direct-to-consumer stores.

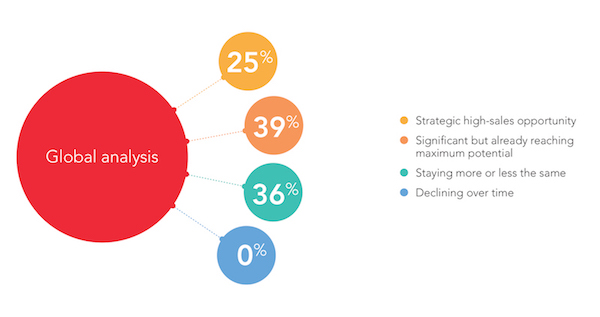

When it comes to the future, how do you view your relationship with Amazon?

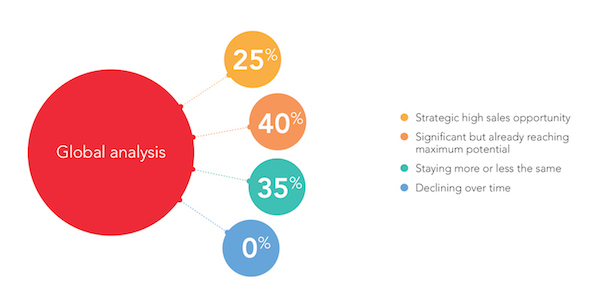

Our respondents still see Amazon remaining a big player for the time being. However, only 25% are of the opinion that it will represent a strategic high sales opportunity for the future, which is an indication that this channel may be reaching a plateau.

This means that many companies are yet to maximize the opportunities offered by having a diverse range of online channels, and therefore

Amazon set to remain a big player, but may be reaching a plateau in terms of its growth

reducing their dependency on Amazon as a percentage of online sales. An over-reliance on one sales channel should be a concern for any retailer, even if the absolute sales number is continuing to grow.

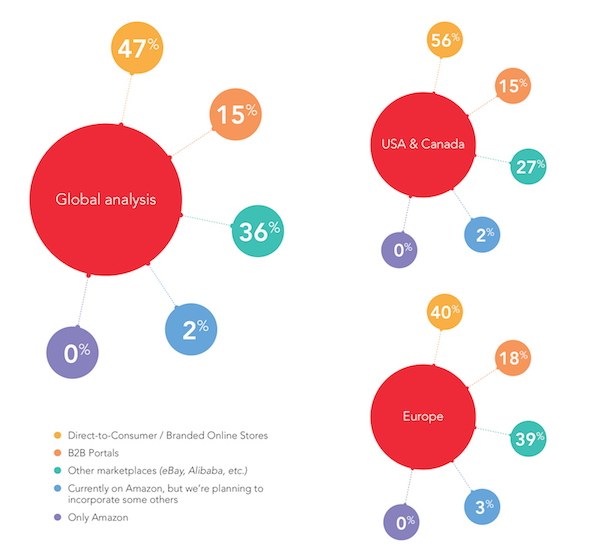

Which other eCommerce channels are you using as part of your online sales strategy?

European respondents are more likely to sell via other marketplaces and B2B portals, while in the USA and Canada they are more likely to sell direct-to-consumer

European respondents are more likely to sell via other marketplaces, while respondents in the USA and Canada are more likely to be selling direct-to-consumer. Perhaps no finding is more significant in terms of the effect of Amazon’s (and other marketplaces) impact on margins.

What is surprising is how many respondents are not selling online for their B2B clients. When we activate this channel for our clients, it enables their sales teams to focus on driving volume rather than on chasing orders.

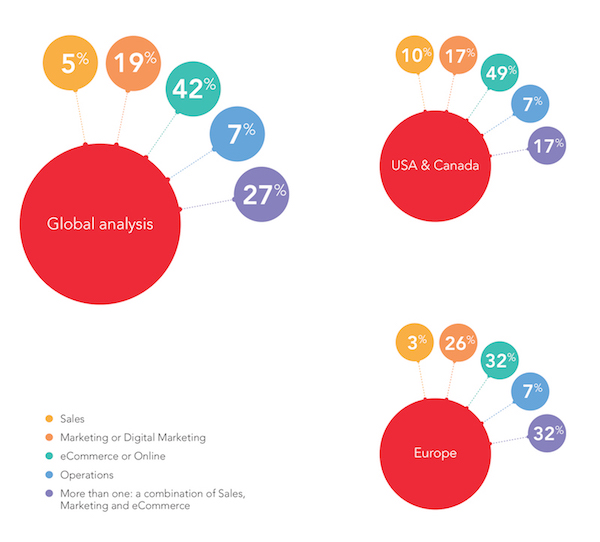

Within your organization, which team is the owner of the eCommerce sales target?

Channel conflict can be a major killer of online growth, and that’s why having shared ownership of the online sales target signed off at a senior level is so important. Having this kind of top-down approval makes sure that all channels are aligned, and goes some way to prevent any internal competition.

Channel conflict is a major killer of online growth

Respondents in Europe are more likely to have shared ownership over the eCommerce sales target compared with their peers in the USA, who are much more likely to have a dedicated team.

Part 3: Building the Online Channel Strategy of the Future

When it comes to the future, how do you view your relationship with Amazon?

Our respondents expect Amazon to remain a big player for the time being. However, only 25% think Amazon will represent a strategic high-sales opportunity for the future, which is an indication that this channel may be reaching a plateau.

However, this is also indicative of a switch in strategy toward a greater diversification of online channels in order to maximize the potential for growth.

Amazon set to remain a big player, but is reaching a plateau in terms of its growth

While sales via Amazon will continue to be an important pillar of their sales strategy, their overall percentage share is likely to shrink. This is good news for manufacturers, as an over-reliance on one sales channel should be a concern for any retailer, even if the absolute sales number continues to grow.

Does Amazon support your international expansion plans?

Retailers in Europe feel that Amazon enables their international expansion plans more effectively

This highlights a consistent theme seen across the survey: Amazon is important, but companies want more diversity and additional channels to drive their online growth.

Respondents in Europe feel that Amazon enables their international expansion plans more effectively, but few brands feel that Amazon supports their international expansion entirely.

More than ever, it’s important for companies to determine their eCommerce strategy across channels. This should include direct-to-consumer online stores but also consider B2B Portals, asset recovery and social media sales where appropriate.

Over the next 5 years, where is the primary focus of your eCommerce strategy?

It is essential for B2B retailers to streamline their eCommerce processes not only internally, but also externally via a single eCommerce platform. This means that they can manage all channels holistically, enabling them to drive maximum sales at higher margins.

As a part of this development, direct-to-consumer stores and non-Amazon platforms will be the biggest priority for B2B retailers over the next ve years. During this time we are very likely to see new marketplaces grow in importance, and new channels rise to prominence.

Direct-to- consumer stores and non-Amazon marketplaces will be a big focus for manufacturers over the next five years

Accelerated eCommerce for ambitious brands

Luzern builds, launches and manages eCommerce execution for market leaders worldwide. With a single connection direct to the Luzern eCommerce platform brands can sell across multiple channels, including B2C stores, marketplaces, B2B portals and specialized asset recovery markets. Luzern clients include: Philips, Nuance, Toshiba, Alcatel, Turtle Beach, Unilever and Morphy Richards.

For more information and to get in touch, please visit luzern.co

WBR Digital conducts industry research and create executive-level content in eCommerce, Procurement, Supply-Chain, and Finance. Find out what your audience are saying.

For more information visit: digitaleu.wbresearch.com